Economics data

Ltd

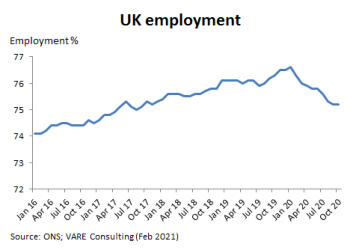

Normally,

employment

numbers

are

a

reasonably

good

proxy

for

office

tenant

demand.

However,

given

the

short-term

disruption

caused

by

the

pandemic,

and

the

furlough

scheme

and

other

supportive

measures,

it

is

likely

that

the

numbers

are

not

truly

reflective

of

the

state

of

the

economy.

We

expect

that

the

number

will

fall

over

the

course

of

2021.

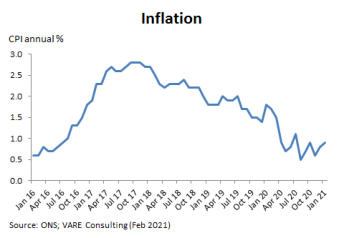

Only

a

few

years

ago,

and

despite

historically

low

rates

of

interest,

inflation

was

exceeding

the

Bank

of

England’s

target

rate.

Now,

with

interest

rates

at

only

0.1%,

the

rate

is less than 1%.

Nevertheless,

there

are

increasing

concerns

that

the

effect

of

the

US

household

stimulus

packages

will

be

to

increase

inflation

in

the

US

and this may spread more globally

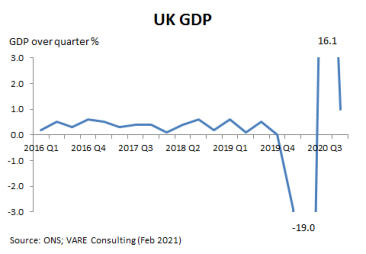

Over

the

last

year,

the

UK

has

experienced

the

most

volatility

it

probably

has

ever

faced

-

all

due,

of

course,

to

the

pandemic

and

the

government stimulus.

In

reality,

the

UK

is

in

a

severe

recession,

but

with

the

potential

to

recover

strongly

in

the

second

and

third

quarters

as

the

‘lock

down’

is

relaxed in phases.

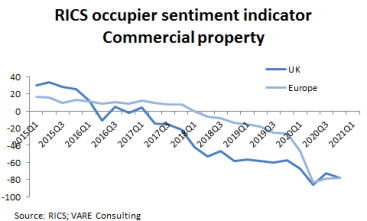

Covid

19

has

had

an

adverse

effect

on

tenant

demand

for

commercial

property.

But

the

deterioration

has

been

happening

for

the

last

five

years

(and

even

before

then),

with

the

UK

leading,

most

likely

driven

by

the

retail

sector,

and

it

is

only

with

the

virus

that

there

has

been

(a

remarkable)

convergence.

Despite

this

deterioration,property

values

have

held

up

well,

with

only

some weakness evident in the UK

Property data