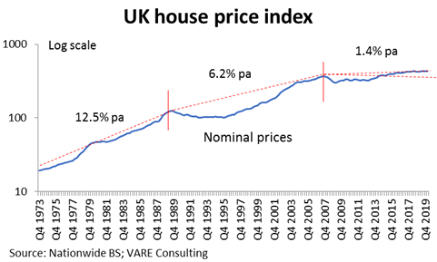

The deteriorating long-term returns from residential property

The

chart

has

been

divided

into

three

distinct

periods,

defined

by

inflection

points

at

price

peaks

and

subsequent

slumps

in

prices.

Why

these

inflection

points,

which

really

only

represent

cyclical

movements,

should

also

represent

secular

changes

is

the

subject

of

a

further

note.

Nevertheless,

the

differences

are

stark,

with

the

most

recent

period

offering

a

very

poor

rate

of

capital

growth

from

the

last

peak

in

2007

to

the

present

day.

The

sharp-eyed

amongst

the

readers

will

see

a

second

dashed

line

on

the

chart

for

the

current

period.

The

lower

one

represents

a

modest

fall

from

the

pricing

peak

and

reflects

a

general

expectation

as

a

result

of

the

2020

recession.

This

is

there

primarily

to

suggest

that

the

upper

dashed

line

represents

a

peak-to-peak

measurement,

comparable to the other measured periods.

Beneficiaries and losers

For sociologists and aspiring owner-occupiers, lower house price growth might be good news. Owning residential assets – the main assets of the population – is no longer producing the growth in wealth for the most affluent. Over time, this will tend to make housing more affordable and to equalise asset wealth across the population. This is being reinforced by the current vogue of a continuing process of property improvement through replacement of parts of the property that are only partially depreciated (eg new kitchen units) for the purposes of style or change for the sake of change. Such activity effectively reduces depreciation of the housing stock but benefits the buyers. For pure investors (non-owner-occupiers) and those owner-occupiers whose main objective is capital appreciation, this might represent a reason to generally avoid the market and to invest their capital elsewhere, such as in equities. Although there are other factors, such as changes in taxation, which have deterred private investors, the lack of capital appreciation is driving a number of private investors from the market as the total returns can often fail to even match the cost of capital. More constructively, it suggests a need to be much more tactical than being a long-term investor. Again, this will be the subject of a further note. For house-builders, a lack of growth in house prices, given that their input costs (labour and building materials) will grow with inflation, places their profits margins under pressure. For them, and contrary to general perceptions, low growth in house prices signifies a lack of demand. One safety valve is the cost of raw land, the price of which will vary depending on demand, as the supply is largely fixed. However, house builders will largely be competing with the existing land uses or alternative uses for the land, and this can limit the responsiveness of land prices to housing demand. Finally, for existing owner-occupiers, most of whom – according to the research – could not afford to buy the house that they occupy, this suggests that they may need to re-think their predilection to own a property greater than their needs and to continuously modernise their homes. The latter activity accelerates the rate of depreciation and produces a poor return on the marginal capital employed which, unless an immediate sale is being contemplated, may be negative. Of course, this is also true of most purchases of chattels, particularly those involving technology, but chattels are not typically purchased to effect a financial improvement in the well-being of the owner. All of the above assumes that the low growth in house prices over the latest period will continue or fall further. I will deal with this in a separate article.

While

UK

commercial

property

ownership

is

dominated

by

investors,

the

residential

market

is

dominated

by

owner-occupiers.

That

indicates

the

need

for

a

different

basis

for

comparing

the

markets:

nvestors

see

total

returns

whereas

owner-occupiers

see

the

market

in

terms

of

capital

pricing

(and

compare,

as

a

separate

calculation,

the

difference

in

mortgage

repayments

–

which

normally

includes

capital

repayment

–

and

the

alternative

of

rent).

In

the

UK,

the

concept

of

implied

rent

as

an

economic

characteristic

of

owner-

occupation

has

been

almost

completely

removed

from

the

population’s

consciousness

with

the

withering

and eventual abolition of UK Schedule A taxation.

Certainly,

there

are

other

players

in

the

residential

market

–

investors

who

rent

out

housing

and

providers

of

social

housing

are

the

two

other

main

owning

groups

–

but

these

are

substantially

price-takers,

with

prices

of

both

land

and

buildings

being

determined

by

the

owner-occupiers

(or

their

agents,

such

as

the

mainstream

house-builders)

who

would

tend

to

out-bid

the

other

groups

in

a

competitive

environment.

This

raises

the

prices

and

lowers

the

returns

to

pure

financially-driven

investors

and

is

the

main

reason

why

institutions,

in

particular,

have

found

it

very

difficult

to

participate

in

this

sector

of

the

property

asset

class

as

opposed

to

commercial

property

where

they

are

the

dominant

holders.

For

owner

occupiers,

owning

is

not

just

about

utility

–

or

having

somewhere

to

live

–

but

also

about

status

and

security.

Investors

seek

to

maximise

net

returns,

whereas

occupiers

seek

to

maximise

social

and

other

benefits,

while

also

seeking

to

at least keep pace with market prices so that they can relocate without losing ‘value’.

The

desire

for

more

and

better

housing,

as

well

as

competition

from

other

land

uses

and

the

restrictions

on

supply

imposed

by

planning

controls,

has

meant

that

house

prices

have

tended

to

rise

over

the

long-term.

There

is

no

law

of

economics

that

says

that

this

has

to

happen,

but

the

tendency

reflects

the

increasing

affluency

of

the

population,

in

particularly

–

in

a

circular

argument

–

the

increasing

affluency

of

the

wealthier

parts

of

the

population.

As

people

become

more

affluent,

they

tend

to

spend

more

of

their

discretionary spending on housing and services.

For

owner-occupier

buyers,

as

opposed

to

owner-occupiers

generally,

the

limiting

factor

on

their

buying

power

is

the

availability

of

finance:

the

equity

(or,

colloquially,

the

deposit)

and

debt

(or

mortgage).

Both

are

largely

dependent

on

household

earnings

and

growth

in

earnings,

although

the

provision

of

mortgages

is,

in

part,

dependent

on

lending

policies

of

banks/building

societies

and

the

control

by

regulators

(now

mainly the Bank of England).

The

Bank

of

England

has

been

particularly

active

in

recent

years

in

attempting

to

avoid

the

risk

of

market

‘over-heating’

by

matching

the

availability

of

mortgage

offers

with

the

long-term

ability

to

service

the

loans.

Even

so,

it

has

probably

only

been

partially

responsible

for

the

slowing

rate

of

house

prices

growth

in the last 50 years, which is shown in the chart below.

Ltd