Like

everything

else

in

life,

property

ages.

The

valuation

methodologies,which

we

describe

elsewhere

ion

the

website,

rarely

reflect

that

and,

instead,

assume

that

income

persists

in

perpetuity.

Yet

the

valuation

processes

typically

do

not

allow

for

a

sinking

fund

to

arrest

the

physical

or

economic

deterioration in properties.

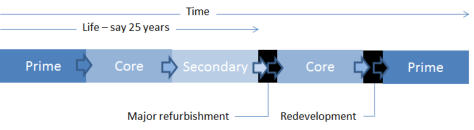

The

chart

above

represents,

in

a

stylised

way,

how

a

property

is

initially

constructed.

At

that

point,

it

is

considered

‘prime’

-

new

or

nearly

new

-

with

a

full

life

expectancy.

Exactly

what

its

actual

life

is

going

to

be

cannot

be

determined.

Its

physical

life

will

largely

be

determined

by

how

well

the

various

components

-

services,

components,

structure,

etc

-

wear

over

time,

but

there

are

unknown

factors

such

as

changes

in

safety

requirements

or

thermal

insulation,

or

unexpected

premature

ageing.

In

general,

the

structural

frame,

whether

it

is

steel,

brick,

concrete

or

even

timber,

should

be

expected

to

have

a

physically

long

life

of

maybe

50

or

100

years

or

more,

with

the

remaining

parts

being

replaced

(much) more frequently.

After

a

number

of

years,

which

might

be,

say,

10,

the

property

becomes

redefined

from

prime

to

‘core’.

Nothing

physically

may

have

changed

significantly

to

the

property,

but

fashion

and

competition

from

new

developments

will

mean

that

it

is

not

quite

as

attractive

as

it

was

before.

Through

the

core

period,

increasing

amounts

of

maintenance

may

be

required,

particularly

to

services

such

as

air

conditioning

and

lifts.

Gradually,

however,

as

it

ages,

it

will

become

less

attractive

to

the

better

tenants

and

the

building

will

be

increasingly

looking

tired.

At

the

age

of,

say,

25

years,

it

may

well

be

considered

‘secondary.’

Eventually,

and

this

may

happen

because

of

difficulties

in

attracting

a

tenant,

a

major

refurbishment

will

be

required.

This

will

bring

back

to

a

core

condition.

Such

a

refurbishment

will

retain

the

physical

structure

and

replace

most

or

all

of

the

other

components,

including

the

services.

Before

then,

there

may

have

been

light

refurbishments,

replacing

fittings

and

finishes,

but

a

major

refurbishment

will

probably

require

planning

consent.

Eventually

after

a

number

of

further

years,

demolition may be the most suitable next stage.

However,

with

the

main

exception

of

residential

property,

the

factor

determining

the

life

of

a

life

of

building

could

possibly

be

economic

obsolescence.

This

means

that

the

building

may

physically

be

able

to

be

used

for

the

original

function

-

but

that

function

may

no

longer

be

economically

viable

(in

which

case

the

building

may

lie

empty)

or

there

may

be

an

alternative

use

which

is

financially

higher

value.

in

the

latter

case,

it

may

be

possible

to

convert

the

space

into

that

alternative

use.

If

that

is

not

possible, demolition and redevelopment might be an attractive option.

Although

economic

obsolescence

is

more

likely

to

occur

in

buildings

which

have

had

use

for

a

number

of

years,

it

is

certainly

not

inconceivable

that

it

can

occur

to

buildings

that

are

still

prime

or,

in

the

most

extreme

case,

still

under

construction.

The

latter

is

possible

in

a

period

where

market

values

are

rising

very

strongly

and

it

is

possible

to

redesign

the

building

to,

perhaps

add

additional

floors

or

change

the

specification

to

meet

demand

for

a

particular

requirement.

A

good

current

example

of

buildings

reaching

the

end

of

their

economic

life

before

they

are

physically

obsolete

is

in

the

retail

sector.

Shopping

centres

that

are

apparently

very

suitable

for

that

use

and

look

very

stylish

may

not

be

attracting

enough

tenant

demand

to

secure

substantial

occupancy.

In

turn,

that

can

depress

rental

values

even

amongst

the

tenants

who

are

still

trading.

It

may

then

be

viable

to

obtain

vacant

possession and convert to, typically, residential.

All

of

this

indicates

how,

even

at

the

most

fundamental

level,

the

returns

over

the

life

of

a

building

may

be

impossible

to

project.

An

appraisal

covering

a

5

or

10year

period

may

be

the

only

practical

assessment

that

can

be

produced,

although

that

will

expose

the

assessment

to

the

vagaries

of

the

cycle,

which

are

rarely

reflected

in

the

projections.

The

other

problem

will

be

the

expected

value

at

the

end point: that will be determined by the equivalent assessment made by the hypothetical purchaser.

Finally,

just

a

word

on

terminology.

As

a

building

ages,

so

it

depreciates,

whether

that

is

physical

or

economical.

The

depreciation

can

be

contained

or

arrested

by

spending

capital

on

it.

Sometimes

the

tenant

may

be

responsible

for

maintaining

the

building

during

the

term

of

a

lease,

but

refurbishment,

major

refurbishments

and

redevelopment

will

be

by

the

landlord

or

owner.

When

a

building

is

no

longer

fit for purpose, it is considered obsolete and, again, that may be physical or economic.

The life cycle of a property

Ltd