Change in the London residential markets

I

n

economic

terms,

the

value

of

residences

in

an

area

is

a

function

of

both

demand

and

supply

and,

therefore,

changes

in

these

can

be

used

as

proxies

for

the

trend

in

values.

While,

in

theory,

supply

and

demand

may

appear

to

be

just

two

sides

of

the

same

housing

market

coin,

there

is

an

important

distinction

between

the

two.

Demand

applies

to

a

requirement

relating

to

the

whole

of

the

existing

housing

stock

whereas

supply

only

applies

to

the

marginal

addition

to

the

stock

arising

from

construction

(and

losses

from

demolition).

Because

that

marginal

change

in

stock

is

typically

very

small

-

it

may

only

be

1%

per

annum

-

the

impact

of

supply

on

prices

is

really

only

seen

in

the

long-term.

Changes

in

the

sentiment

of

purchasers

(the

perpensity

to

consume

in

economic

terms)

can,

and

do,

have

an

immediate

effect,

and

it

is

this

that

drives

prices

in

the

short-term.

Most

typically,

such

short-term

changes

are

the

result

of

financial

changes,

such

as

varying

interest

rates,

employment

(job

opportunities)

rates

rising

or

falling,

inflation

rising

or

falling,

and

economic

growth

influencing wealth growth and confidence.

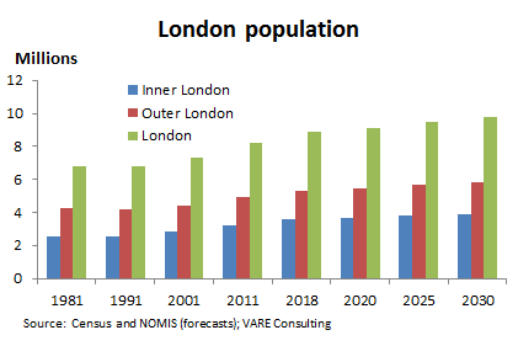

With

a

population

of

some

9m

(estimated

2020),

London

is

the

largest

city

in

Europe.

Since

1988,

its

population

has

been

rising,

fuelled

by

an

influx

of

domestic

and

foreign

graduates

(looking

for

their

first

post-

graduate

job),

immigrants

from

outside

the

EU,

and

by

EU

professionals

(attracted

by

the

the

biggest

financial

centre

in

Europe).

This

has

generated

incredible

demand

for

housing,

raising

house

prices

and

rents,

encouraging

much

new

high

rise

and

other

development,

and

increasing

‘densification’

in

the

existing

stock.

But

to

put

that

into

context,

in

1939,

its

population

was

8.6m,

declining

to

a

low

in

the

1980s

before

it

grew

to

reach

a

new

peak

in

2018

of

8.9m.

The

population

growth

rate

has

been

accelerating

in

recent

decades,

from

0.7% pa in the 1990s, to 1.7% pa in the 2000s and 1.8% pa in the 2001-2018 period.

Until

the

pandemic,

the

consensus

forecasts

were

for

slightly

under

1%

pa

population

growth

over

the

next

10

years,

as

is

illustrated

in

the

chart

above.

Indeed,

it

is

probable

that

the

population

growth

in

2019

and

2020

has

already

shown

signs

of

slowing

growth,

in

large

part

because

of

issues

of

affordability,

a

lesser

number

of

graduates

moving

to

London,

fewer

job

opportunities

in

the

capital,

partly

because

of

the

transfer

of

jobs

from

London

to

the

provinces

by

the

government,

and

lower

international

migration

to

the

city

as

a

result

of

the

pandemic and Brexit.

Of

greater

concern

is

that

PwC,

in

a

report

at

the

beginning

of

2021,

estimates

that

the

number

of

people

living

in

the

capital

could

fall

by

more

than

300,000

in

2021,

or

3.3%,

to

8.7m.

What

is

unknown

at

this

stage

is

whether

the

drop

in

growth

is

a

permanent

feature,

accentuated

by

the

apparent

desire

of

some

workers

to

move

outside

the

capital

so

that

they

can

afford

a

larger

property

(with

room

for

a

proper

home

office)

and

garden.

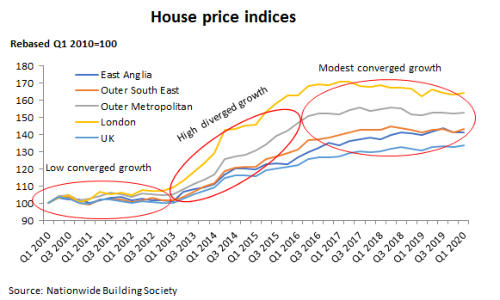

The

chart

below

shows

how

the

southern

UK

markets

have

been

performing

for

the

last

10

years.

In

the

recession

of

20089,

house

prices

fell

significantly,

but

then

stabilised

in

the

southern

UK

regions

(although

continuing

to

fall

in

the

northern

regions)

quite

rapidly

as

interest

rates

were

dramatically

lowered

to

stimulate

the

economy.

As

quantitative

easing

was

introduced

in

the

intermediate

phase

on

the

chart,

hiopuse

prices

rose

very

strongly,

recovering

from

the

falls

in

the

2008/9

period,

led

by

London.

The

final

phase

was

more

modest

growth

generally,

but

with

modest

falls

in

London

prices.

That

might

suggest

that

the

question

of

affordability

was

a

key

reason

for

what

appears

to

be

a

shift

in

demand

from

central

london

to

the

home

counties.

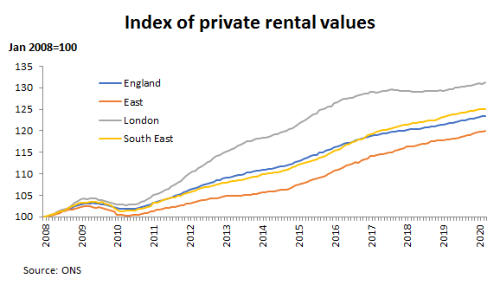

This

conclusion

is

reinforced

by

the

contents

of

the

chart

below.

With

some

variation

in

the

first

phase,

the

data

relating

to

rental

values

shows

a

pattern

similar

to

those

of

the

capital

values.

We

view

the

rental

value

chart

as

indicating

demand

for

occupancy,

and

its

difference

to

the

capital

value

one

as

indicating

the

appetite

for

risk

in

committing

to

purchase.

This

shows

some

weakening

in

demand

for

London

in

the

third

phase,

but

still stronger demand than would be implied by the capital value line.

Our

conclusion

from

the

combined

intelligence

in

these

charts

is

that

the

reduction

or

stabilisation

of

demand

was

mainly

due

to

the

affordability

argument

for

central

London

but

that

there

was

also

an

element

of

reduced

demand from a desire to move outwards from the capital.

For

those

who

are

continuing

to

work

in

London,

the

penalty

of

moving

further

out

is

the

increased

cost

of

commuting,

so

the

greater

affordability

of

more

peripheral

housing

is

substantially,

or

even

completely,

mitigated

by

a

reduced

household

net

earnings

cashflow,

although

its

should

be

noted

that

this

a

different

issue

to

the

capital

cost/commitment

one

that

may

be

the

determining

factor

in

the

house

acquisition.

But

as

house

prices

rise

outside

the

capital

and

those

of

London

stabilise

or

afll,

the

affordability

argument

becomes

weaker and this will be the natural stabilisation.

In

the

short

term,

London

prices

are

expected

to

remain

weak

on

that

argument,

and

there

are

risks

attached

to

the

partial

or

wholly

‘working

from

home’

expectation,

which,

at

the

very

least,

will

defer

the

stabilisation

point

to

some

what

further

into

the

future.

For

potential,

but

not

committed,

London

investors,

this

gives

time

to

invest

very

selectively

and

at

what

might

prove

good

prices

in

the

future

as

we

see

an

eventual

recovery

in

London

house

prices.

At

worst,

we

should

expect

no

lesser

growth

in

London

prices

than

in

the

home

counties

in

the

medium

term.

After

all,

it

is

central

London

jobs

that

are

driving

the

demand

for

housing

in

both

London

and the home counties.

Ltd